Probate Lawyer in Vero Beach: No Money Down Probate Services Available

Click Here to Register for Our Next Estate Planning Workshop

Probating the estate of a loved one can feel like an overwhelming undertaking. Unfortunately, many people are unaware of their duties when they embark on the probate journey. These duties could include paying debts, locating assets, and attending court hearings. At Lulich & Attorneys, we understand these challenges and are proud to offer No Money Down Probate services to help ease the financial burden while providing expert legal support.

You may feel stressed and stuck if you’re in charge of settling your loved one’s affairs. Perhaps you accepted the responsibility of being an executor out of a sense of duty to your late family member, or maybe you genuinely felt empowered to do it. On the other hand, the gravity of the responsibility might have just occurred to you, leaving you to question whether or not you’re qualified to do the job.

Lulich & Attorneys can support you. A Vero Beach probate lawyer at our firm can support you as you work to settle your loved one’s estate and honor their final wishes. Call us for a consultation to discuss your duties and how we can assist you.

A Vero Beach Probate Attorney Can Help You Fulfill Your Duties

Given your extensive and complex responsibilities as a personal representative, enlisting a probate lawyer in the Vero Beach area can significantly ease your burdens. However, it may prove difficult to handle coordinating the multiple parts of probate while also grieving the loss of your loved one and supporting your family through this tragic time.

Our law firm can take on the bulk of your probate duties, so you can focus on healing emotionally. Dedicated legal help can also save you time and money as our lawyers have years of experience and knowledge that enable our efficiency in handling your case.

Lulich & Attorneys Has the Resources to Locate Assets, Creditors, and People

Our law firm possesses the financial and human resources to carry out estate administration tasks.

As a personal representative, you’ll need to locate and determine the value assets, such as:

- Bank accounts

- Businesses

- Real estate

- Jewelry

- Furniture

- Cars

Additionally, you must pin down and pay beneficiaries and debts. This can prove especially challenging if there’s no will to direct you. We have the financial means and the streamlined systems to locate assets, debts, and people. We can notify creditors, beneficiaries, and potential heirs of their rights per the law and ensure to properly allocate their money. We have the financial wherewithal to support you through all your duties as you administer the estate.

We Handle Complex Legal Paperwork

Legal paperwork makes up a significant portion of probating an estate. We can not only explain the documents required, but fill them out, file them with the court, or submit them to other required parties on your behalf. We can also help you locate the will and ensure it’s filed with the court on time or within the legal exceptions. Additionally, we send out mandatory notifications to creditors, heirs, and others who have a stake in the estate and assist you in filing any estate or individual tax returns.

Handling Legal Disputes

If a dispute arises, our probate lawyers in Vero Beach can represent you and the estate in proceedings. A probate litigator on our legal team can help you defend against improper claims of debt or inheritance. Beneficiaries may also require our help representing their interests in a probate dispute. We help you build a case for your rightful inheritance. In either situation, our attorneys can work hard to bring you a favorable outcome.

What Is Probate?

Counter to what television displays, you must deal with more than just the will after someone’s passing. In some cases, reviewing the will marks the beginning of handling the affairs after death. However, many other matters may require attention—including probate.

Probate refers to the court-supervised process of settling debts and distributing the assets of someone after they die. They must transfer all their accounts, property, and money to someone else. If a will exists, settling the estate may prove smoother than if no will exists; however, in either case, you must work through the steps of probate.

If the Decedent Has a Will, Is Probate Necessary?

Even when the decedent left a will, you may need to go through probate. This is because the court may need to validate the will, among other tasks. However, a lawyer from our team can explain if you have options to avoid probate altogether.

How Does Probate Work in Vero Beach?

There are numerous aspects to probate. In our state, a circuit court judge oversees probate. The following include the central aspects of probate:

Probate Occurs in Circuit Court

The judge must confirm the beneficiaries to the decedent’s estate, validate the will, and approve the personal representative. The judge essentially has the final say in the outcome of probate court.

A Personal Representative Handles the Estate

A personal representative bears responsibility for settling the estate. If the decedent died with a will, they are called testate. If they did not make a will, they are called intestate. A testate decedent most likely named someone they wanted to execute their wishes upon death. In this case, the personal representative is also known as an executor.

If the decedent was intestate, they did not name a personal representative, so the court must select one. The circuit court will then officially appoint a personal representative to begin the probate process.

The judge can appoint any of the following as a personal representative:

- Spouse

- Child

- Parent

- Sibling

- Another relative

- Bank

- Trust company

- A resident of the state unrelated to the decedent

What Does a Personal Representative Do?

The personal representative’s duties include:

- Locating the will

- Filing the will with the court within ten days of death (with possible exceptions to this deadline)

- Identifying, gathering, valuing, and protecting the decedent’s assets

- Notifying others of the right to object to the court’s appointment of a personal representative

- Finding any heirs or beneficiaries

- Notifying creditors that they have a right to make a claim against the estate for debts

- Paying off valid debts

- Defending the estate against improper claims and lawsuits

- Filing and paying applicable taxes

- Paying the costs of administering the estate

- Disbursing assets to the beneficiaries

Other duties may exist beyond this list. During your consultation, a probate lawyer can explain your additional responsibilities as the executor or estate administrator.

What Happens With Probate if There Is No Valid Will?

A will provides direction on how the deceased wanted their assets allocated and how they wanted to handle important decisions in their absence. For instance, the testator details who they wish to inherit their assets and care for their children. Without a will in place, the state will decide those matters. If your loved one passed away without a valid will, the state’s intestate succession laws determine who inherits the estate.

The following includes the succession of inheritance in order of priority:

- Spouse

- Children

- Parents

- Siblings

Without any of the above relatives, the inheritance proceeds to the next of kin. Without any surviving family, the estate may go to the state.

How Is the Inheritance Distributed in a Vero Beach Probate Case?

The court divides the shares of the estate in the following manner:

- If the decedent had a spouse and no surviving children, the spouse inherits the entire estate.

- If the decedent and their surviving spouse had children together, the spouse inherits everything.

- If the decedent only had children from a past relationship and not from the surviving spouse, the spouse receives 50 percent of the estate, and the children receive the other 50 percent.

- If the decedent had no spouse or children, the estate may go to their surviving parents, if any exist.

- Without a spouse, parents, or descendants, the estate proceeds to their siblings or, if there are none, maternal and paternal relatives.

Avoiding Probate in Vero Beach

Certain assets do not have to pass through probate, including:

Assets With a Named Beneficiary and Payable-on-Death Accounts

Assets with a designated beneficiary do not go through probate in most cases. The court does not have to get involved when you know the identity of the person inheriting the asset, and you have instructions regarding the dispersal of those assets. Insurance policies, retirement accounts, and annuity contracts may not have to pass through probate because they have a named beneficiary.

Transfer-on-death (TOD) and payable-on-death (POD) accounts can also avoid probate. TOD accounts are transferred into the beneficiary’s name, who then manages the account. A person can also transfer real estate to a beneficiary using a transfer-on-death deed. POD accounts refer to bank accounts with a named beneficiary who receives the money if the account owner dies.

POD accounts include:

- Savings accounts

- Checking accounts

- Certificate of Deposits (CD)

Jointly Owned Assets With a Right of Survivorship

Jointly held assets with a right of survivorship do not have to go through probate. Right of survivorship means that the surviving owner receives full ownership if the other owner passes away. Property held in joint tenancy is not a probate asset. Similarly, property owned by spouses as tenancy by entirety is not a probate asset. Instead, the surviving spouse retains sole ownership of the asset.

Examples of assets that can have a right to survivorship include:

- Joint bank accounts

- Real estate

- Cars

Assets in a Living Trust

Assets held in a living trust— also called a revocable trust— do not go through the probate system. When someone sets up a trust, the trust becomes the legal owner of the assets placed within it. The person who set up the trust is usually the trustee, but they can name someone else to the position. After the original owner/trustee passes away, the trust goes to a designated trustee who then must distribute the contents of the trust to the beneficiaries named on the trust document. Again, you can handle this privately without the intervention of the courts.

If your loved one held both probate and non-probate assets, a Vero Beach probate attorney at our firm can help ensure that the transfer of either asset type happens as smoothly as possible.

What Are the Costs of Probate?

The costs of probate proceedings will vary by case. Generally, you can expect probate attorney fees, filing fees, administrative costs, and the personal representative’s commission. You can usually pay these costs out of the estate. You may deal with costs for resources used to locate people and assets and costs associated with litigating in court. The law firm may front these costs and seek to reimburse them from the estate at closing.

To do so, the personal representative must pay all costs properly and open an estate bank account. They must keep any personal finances separate from estate finances to avoid accusations of fraud, theft, or mismanagement as much as possible. Additionally, it’s worth mentioning that if a personal representative mismanages the estate or the beneficiaries suffer harm due to your actions as a personal representative, you may bear liability for the damages they suffer.

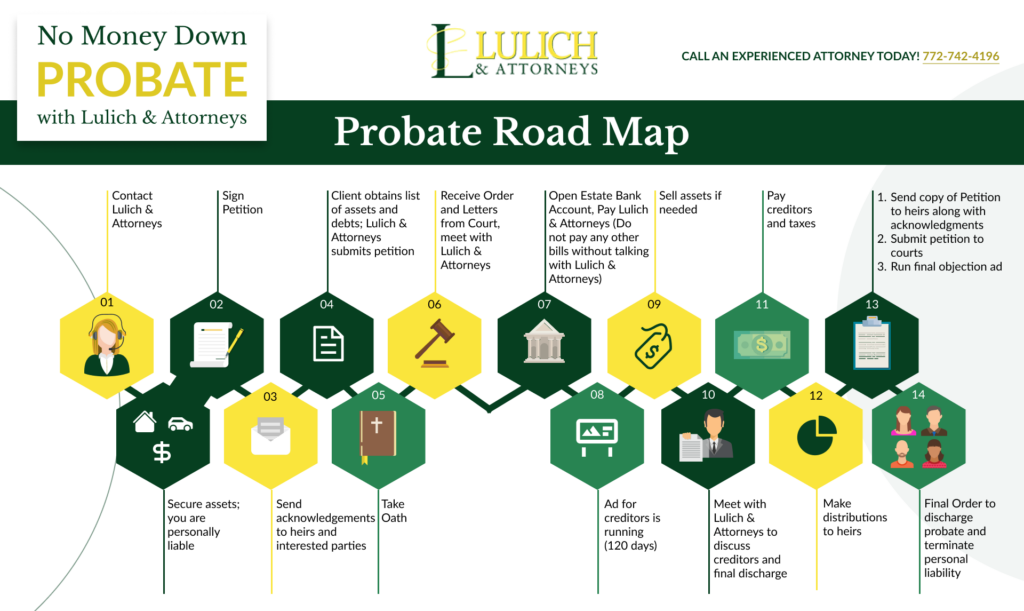

Our No Money Down Probate service allows you to begin the probate process without worrying about upfront legal fees. Attorney costs and court fees can be paid out of the estate once it’s settled, making it easier for you to focus on your duties without financial stress. Our process ensures that we handle the heavy lifting while keeping you informed every step of the way. Whether you’re managing debts, handling disputes, or distributing assets, we work to resolve your case efficiently and compassionately.

How Long Does Probating an Estate Take in Vero Beach?

You can reasonably expect probate to take between six (6) to twelve (12) months on average. Any number of situations could draw out the time. For example, the process may take longer if the personal representative needs to sell the property to cover debts or a legal dispute arises. All estates in probate must remain open for at least three months, as this is the time the state provides for creditors to make a claim for money owed.

The final accounting documents and other paperwork necessary to close the estate are due within the first 12 months of the judge appointing a personal representative. Still, the court provides extensions for multiple reasons, including filing tax returns.

If a loved one passes away without a will in place, probate is the judicial process of distributing the deceased person’s assets and settling any debts. Upon a person’s death, notice is given to heirs and beneficiaries, as well as creditors. Any debts or owed taxes are paid and the remaining is distributed per the decedent’s wishes, or according to state law if there is not will. Hiring an attorney can help avoid probate in certain situations:

- The Titling of Assets

Assets which are held as joint tenants with a right of survivorship – or tenants by the entirety (essentially a joint tenancy between spouses) can pass directly to the other joint tenants or a spouse without the need to go through probate. In addition, homes, bank accounts and other financial assets can be joint with the right of survivorship or as tenants in the entirety. - Payment of Death Documents

Documents such as life insurance policies and bank accounts should name specific beneficiaries who will receive the proceeds or assets when the decedent dies. Your lawyer at Lulich & Attorneys will explain which documents should be made payable on death and how to formally complete the documentation requirements. - Trust Agreements

Are legal documents an Indian River County resident creates. The creator places some assets in trust for the use by a beneficiary. A trustee that the creator appoints manages the trust. The trust assets do not pass through the estate, meaning they do not require probate. Trusts are often created for minors, people who are not competent, non-profits, and charities. - Business Succession Plans

There are three basic types of business interests – partnership, stock in a corporation, and a sole proprietorship. Through partnership agreements, stock ownership agreements, and other documents – you may be able to transfer business interests without the need for probate.

IRAs, annuities, and other retirement accounts are assets that may be able to avoid probate.

Selecting the Right Personal Representative

Selecting a personal representative helps anyone concerned about their estate prepare a will. The personal representative will state who you choose as an executor and you can even appoint more than one executor. Your personal representative acts in a fiduciary capacity, meaning the representative is subject to lawsuits for nonperformance or incompetent performance. You may also appoint a spouse or an adult child as a personal representative. Whoever you choose, you should make sure the representative is able to perform the following:

- Make an inventory of all assets

- Obtaining certificates of appointment

- Open an estate checking account

- Determine who is entitled to assets under the will or the Florida interstate laws

- Notify creditors that the decedent has died

- Arrange for the sale or transfer of a home and any personal assets

- Pay the funeral and burial expenses

- Prepare, file, and pay any outstanding income taxes, fiduciary income taxes, and any estate taxes

- Resolve any claims by creditors – through settlement or litigation

- Manage estate assets until they’re ready for distribution

- Determine how much assets should be sold for

- Prepare an accounting of financial transactions

- Distribute assets to heirs and beneficiaries after court approval

Why Choose Lulich & Attorneys for Probate?

We are committed to making probate as seamless as possible for our clients. With our No Money Down Probate services, you can start the process without upfront legal fees. This allows you to proceed confidently, knowing financial constraints won’t delay honoring your loved one’s final wishes.

How We Help You Fulfill Your Probate Duties

Probate is a complex legal process, but with our assistance, you can navigate it efficiently and with peace of mind. Here’s how we help:

- Locating Assets, Creditors, and Beneficiaries: Our team has the resources to identify and value assets like bank accounts, real estate, and personal property. We also notify creditors, beneficiaries, and potential heirs as required by law.

- Handling Legal Paperwork: From filing the will to preparing and submitting tax returns, we take care of all documentation to ensure accuracy and compliance.

- Resolving Disputes: If conflicts arise, our probate attorneys are skilled in litigation to protect your interests and achieve fair resolutions.

Our Vero Beach Probate Lawyers Help You Close an Estate With Confidence

At Lulich & Attorneys, we know how difficult handling the probate process can be. Carrying the grief of losing a loved one and attempting to sort through the details of their life can feel like a great deal for one person to bear alone. Let a Vero Beach probate attorney at our firm help you through the process. With our No Money Down Probate services, you can move forward confidently, knowing our experienced Vero Beach probate lawyers are on your side. We can carry the bulk of the weight of settling the estate so you can feel confident that it’s handled properly and know you’re not alone.

Contact us today for a consultation so we can get started: (772) 589-5500.

Estate planning is a comprehensive process that involves making arrangements and decisions to manage your assets and affairs during your lifetime and after your passing. It encompasses the creation of a strategic plan to distribute your wealth, property, and possessions in a manner that aligns with your wishes and maximizes benefits for your loved ones.

Our Vero Beach attorneys have created this guide to help you understand the process of estate planning. Download your copy today!